Credit Analysis & Research (CARE) has assigned 'BB' rating against Rs 310 million long-term bank facilities of Stone India. CARE also has assigned 'A4'ratings against Rs 98 million to the company's short-term bank facilities.

The aforesaid ratings are constrained by Stone India's (SIL) high customer concentration risk, tender based business - limiting the ability to pass on an increase in the raw material prices and moderate financial risk profile with high utilization of the working capital limits.

The aforesaid ratings are constrained by Stone India's (SIL) high customer concentration risk, tender based business - limiting the ability to pass on an increase in the raw material prices and moderate financial risk profile with high utilization of the working capital limits.

The above constraints are partially offset by the experienced promoters, long track record of operations, strong R&D capability, strong presence in various product lines, high entry barrier and satisfactory order book position.

Ability of SIL to improve its profitability margin and efficiently manage its working capital cycle is the key rating sensitivities.

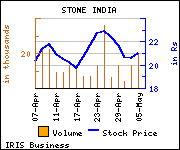

Shares of the company declined Rs 0.35, or 1.67%, to trade at Rs 20.65. The total volume of shares traded was 8,126 at the BSE (1.52 p.m., Tuesday).